How AP Leaders Can Start the Year Strong and Finish It Transformed

January is when people take a hard look in the mirror.

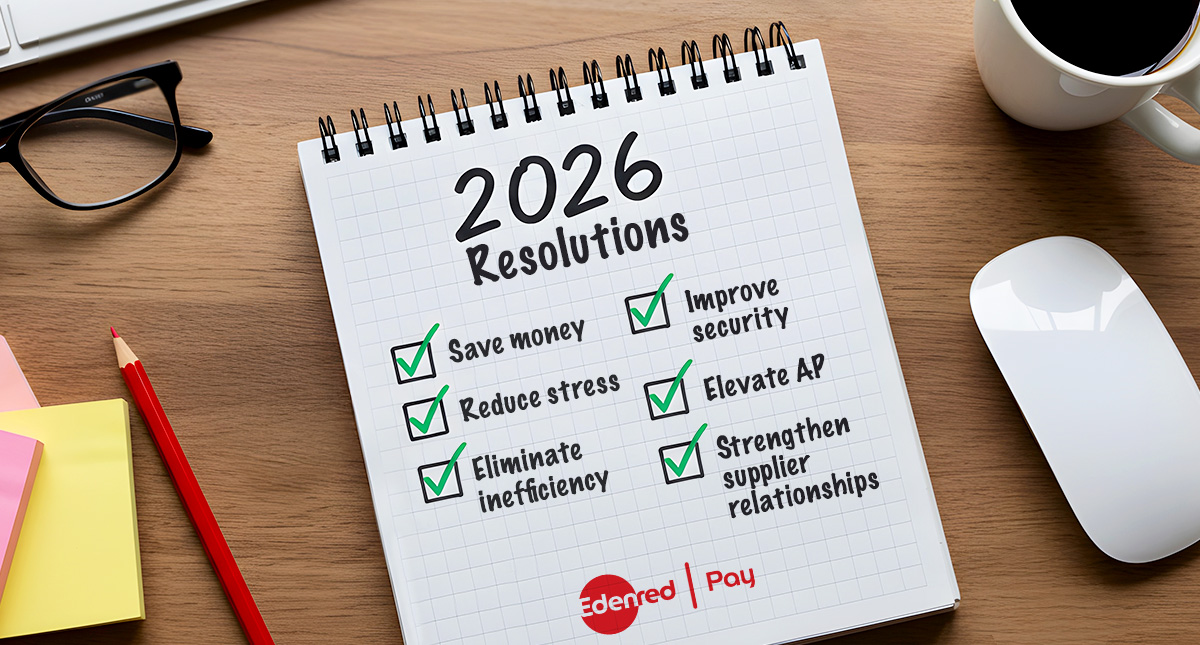

They resolve to save more money, lose excess weight, strengthen relationships, reduce stress, and build better habits that stick beyond February. And while those resolutions often start at home or the gym, the same mindset belongs to the accounts payable (AP)The amount a company owes to suppliers for goods and services received but not yet paid. department, especially as expectations for AP continue to rise.

For AP leaders, the New Year isn’t just a fresh calendar. It’s a chance to reset how invoice-to-pay operates, how the team spends its time, and how the function supports the business. Manual processes that felt tolerable last year suddenly feel heavier. Friction with suppliers becomes more visible. Risks that once seemed manageable now feel unacceptable.

The good news? The same resolutions people set for themselves map almost perfectly to the resolutions AP leaders should be setting for invoice-to-pay.

Below are the New Year’s resolutions that matter most for AP, and how modern invoice-to-pay automation helps turn them into reality.

Resolution #1: Save Money (and Prove It)

“Spend less” is one of the most common New Year’s resolutions for individuals. For AP leaders, the equivalent is reducing the cost-to-process invoices and payments, without sacrificing control or accuracy.

Yet many AP departments still burn budget on:

- Manual invoice entry and corrections

- Duplicate or erroneous payments

- Late fees and missed discounts

- Labor-intensive check processing

Invoice automationThe use of technology to eliminate manual tasks in the invoice processing lifecycle – from receipt to approval and ERP posting. is often the first, and most impactful, place to start. By automating invoice capture, data extraction, validation, and routing, AP teams dramatically reduce the time and cost required to process each invoice. Fewer touches mean fewer errors, fewer exceptions, and fewer downstream issues that quietly drain budget.

But savings don’t stop at invoices.

Supplier payments automation reduces the high cost of paper checks, minimizes reissuances, and lowers bank fees tied to inefficient payment methods. And when invoice automationThe use of technology to eliminate manual tasks in the invoice processing lifecycle – from receipt to approval and ERP posting. and payments automation work together in a single invoice-to-pay flow, organizations gain visibility into true processing costs, something many AP leaders struggle to quantify today.

This resolution isn’t just about spending less. It’s about finally having data-backed proof that AP is running leaner, smarter, and more efficiently.

Resolution #2: Lose the “Process Weight” Holding AP Back

Another classic resolution: lose weight. In AP, that translates to shedding the process bloat that accumulates over time.

Think about it:

- Extra approval layers added “just in case”

- Manual workarounds created for edge cases that became the norm

- Side spreadsheets tracking what systems can’t see

- Email chains replacing structured workflows

All that weight slows AP down.

Invoice-to-pay automation helps AP leaders slim operations by replacing patchwork processes with standardized, automated workflows. Invoices flow in digitally, exceptions are flagged intelligently, approvals follow clear rules, and payments are triggered without manual handoffs.

Virtual cardA single-use or vendor-specific digital payment card used in B2B payments to improve control, visibility, and rebate potential. W payment automation adds another layer of efficiency by eliminating entire steps from the process. There’s no printing, signing, mailing, or reconciling checks, just secure, automated payments that post cleanly back to the system.

The result? A lighter, faster AP operation that can move at the speed the business expects, without burning out the team.

Resolution #3: Strengthen Supplier Relationships

Many people resolve to invest more in relationships in the New Year. AP leaders should too because supplier relationships are built or broken in invoice-to-pay.

Late payments, poor communication, and confusing remittance details frustrate suppliers and flood AP inboxes with “Where’s my payment?” inquiries. That friction costs time, goodwill, and credibility.

Supplier payments automation transforms this dynamic. Suppliers receive payments faster, more reliably, and with clearer remittance data. Virtual cardA single-use or vendor-specific digital payment card used in B2B payments to improve control, visibility, and rebate potential. W payments can provide immediate settlement while reducing risk for both sides.

When invoice and payment data are connected end-to-end, AP teams can respond to supplier questions with confidence instead of scrambling across systems. Some organizations see supplier inquiries drop dramatically once automation is in place, freeing AP staff to focus on higher-value work.

Strong relationships don’t come from more emails. They come from predictable, transparent, and professional payment experiences.

Resolution #4: Reduce Stress and Fire Drills

Few New Year’s resolutions are more universal than “reduce stress.” AP leaders know exactly what that stress feels like:

- Month-end invoice backlogs

- Last-minute payment runs

- Emergency check requests

- Audit requests that derail the team for days

Manual invoice-to-pay processes amplify stress because everything depends on people remembering, checking, and rechecking.

Invoice automationThe use of technology to eliminate manual tasks in the invoice processing lifecycle – from receipt to approval and ERP posting. removes much of that anxiety by ensuring invoices are captured, tracked, and routed consistently. Payment automation ensures nothing slips through the cracks. And when these capabilities are unified in an invoice-to-pay platform, AP leaders gain real-time visibility into what’s been received, approved, paid, and reconciled.

Virtual cardA single-use or vendor-specific digital payment card used in B2B payments to improve control, visibility, and rebate potential. W payment automation further reduces stress by minimizing fraud exposure and eliminating the risks tied to lost or altered checks.

Less chaos. Fewer surprises. More control.

Resolution #5: Build Better Habits That Stick

Anyone who’s set a New Year’s resolution knows the hardest part isn’t starting. It’s sustaining change.

The same is true in AP.

Temporary fixes and point solutions often improve one step while leaving the rest of the process untouched. Over time, bad habits creep back in, and teams revert to manual workarounds.

Invoice-to-pay automation creates better habits by design. It enforces standardized processes, embeds controls directly into workflows, and makes the right way the easy way.

Invoice automationThe use of technology to eliminate manual tasks in the invoice processing lifecycle – from receipt to approval and ERP posting. ensures invoices enter the system consistently. Payment automation ensures suppliers are paid on time using the most efficient method. Virtual cardA single-use or vendor-specific digital payment card used in B2B payments to improve control, visibility, and rebate potential. W automation creates a path for secure, electronic payments. Together, they form a repeatable, scalable operating model that holds up as volumes grow.

Good habits don’t require constant reminders when the system reinforces them automatically.

Resolution #6: Improve Security Without Slowing Down

Security may not make most personal resolution lists, but for AP leaders, it’s top of mind, especially as fraud schemes grow more sophisticated.

Manual invoice and payment processes introduce risk:

- Email-based approvals

- Manual vendor changes

- Paper checks vulnerable to interception

- Limited visibility into who did what, and when

Modern invoice-to-pay automation embeds security and controls into every step of the process. Invoices are validated automatically. Approvals are tracked and auditable. Payments follow predefined rules.

Virtual cardA single-use or vendor-specific digital payment card used in B2B payments to improve control, visibility, and rebate potential. W payment automation adds another powerful layer of protection, reducing exposure by eliminating sensitive bank account information and minimizing the attack surface for fraudsters.

The best part? Stronger controls don’t slow AP down. They make it faster and safer at the same time.

Resolution #7: Elevate AP’s Role in the Business

Many professionals resolve to advance their careers in the New Year. For AP leaders, that means moving beyond transactional work and being recognized as a strategic contributor.

That shift doesn’t happen through harder work. It happens through smarter systems.

When invoice-to-pay is automated end-to-end, AP leaders gain access to insights around spending, cash timing, supplier performance, and working capital. Conversations with finance and leadership shift from “we’re behind” to “here’s what the data shows.”

Invoice automationThe use of technology to eliminate manual tasks in the invoice processing lifecycle – from receipt to approval and ERP posting., payments automation, invoice-to-pay automation, and virtual cardA single-use or vendor-specific digital payment card used in B2B payments to improve control, visibility, and rebate potential. W automation are enablers of a more strategic AP function.

Make This the Year that Your Resolutions Actually Stick

Most New Year’s resolutions fail because they rely on willpower instead of systems.

AP transformations succeed when the process itself changes.

By modernizing invoice-to-pay with automation, AP leaders can:

- Save money

- Eliminate inefficiency

- Strengthen supplier relationships

- Reduce stress

- Improve security

- Elevate AP’s role in the organization

This year, don’t just resolve to “do better.” Resolve to build an invoice-to-pay process that works better, every day of the year. Because when AP starts the year with the right foundation, the results last far beyond January.

Ready to elevate your B2B payments?

Whether you are automating for the first time, ready to refresh your existing technology, or looking for ways to complete the ‘last mile’ of automation, Edenred Pay can help. Let’s chat about your needs.