Benefits of Robotic Process Automation in AP

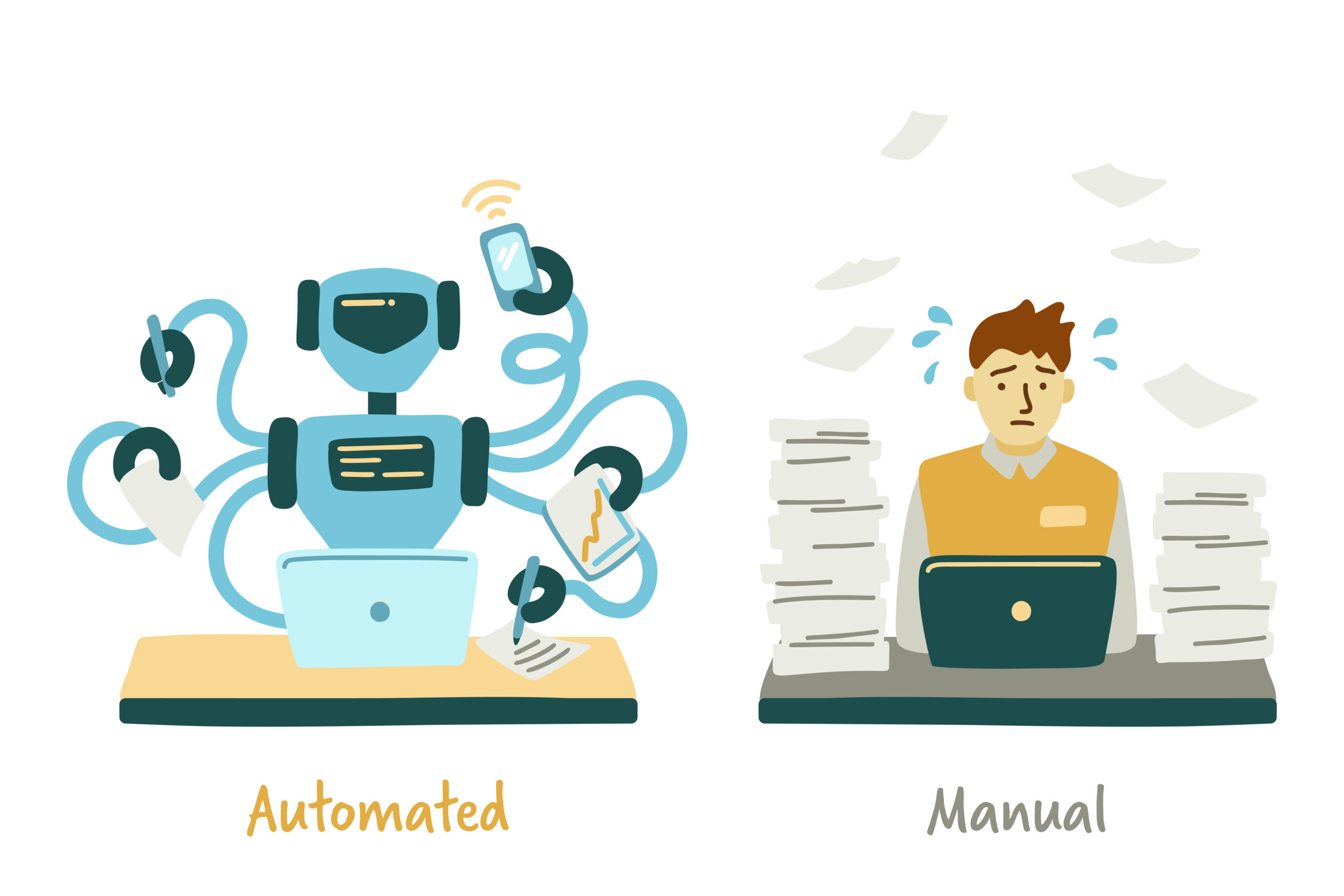

AP automation solutions use RPA to digitize and simplify AP and invoice processing to streamline media payables and other financial applications.

Whether it was a keynote address, a breakout educational session or a networking function, you couldn’t go far at the recent Shared Services & Outsourcing Week without hearing shared services and AP leaders buzzing about the potential of robotic process automation (RPA) to streamline accounts payable and invoice processing.

The technology also was a top-of-mind issue for shared services and AP leaders visiting the Edenred PayEdenred Pay is the market leader in B2B payments automation. booth in the expo hall, too.

Forty-seven percent of shared services leaders admit that their operations are not very automated, according to SharedServicesLink’s Setting Your P2P Strategy for 2018 and Beyond study. Ninety-one percent of shared services leaders want to improve their organization’s level of automation for applications such as invoice processing.

AP and invoice processing are long overdue for automation.

Front-line staff in many shared services organizations spend most of their day retrieving invoices sent to an e-mail box or portal, manually keying or cleaning up poor optical character recognition (OCR) invoice data, handling invoice exceptions, hunting down approvers, physically routing invoices, making calls and e-mails to determine the status of invoices and payments, and filing invoices and other payables documents. Many shared services organizations must also key or monitor data on approved invoices in their enterprise resources planning (ERP) platform.

Why shared services departments should automate AP

- Only 11 percent of shared services organizations can post more than 75 percent of their invoices to their ERP without human operator intervention, SharedServicesLink finds.

- Fifty-four percent of shared services organizations are not very flexible or scalable.

- Seventy-two percent of shared services organizations want to become more efficient.

This is untenable for a function established to be a “Center of Excellence” for the enterprise.

That’s where the RPA capabilities built into the best AP automation solutions come in.

Invoice processing software uses RPA software “bots” – developed by accounts payable automation subject matter experts – to automate tasks ordinarily performed by shared services staff:

Opening a supplier portalA self-service web portal for suppliers to submit invoices, check payment statuses, and update account information. to retrieve invoice submissions

- Extracting data from fields on an invoice or other payables document

- Monitoring queues such as those for invoices awaiting processing

- Routing invoices for approval or exceptions handling based on pre-set business rules

And importantly for shared services and AP leaders, RPA is fast. The invoice processing technology performs tasks more than 20 times faster than a human operator – and it never gets sick, tired or distracted or requires a break.

The combination of RPA technology with subject matter expertise and application integration drives productivity and immediate value through the elimination of manual intervention in accounts payable. Eliminating manual AP tasks with RPA frees shared services staff to focus more of their time on value-added activities, such as data analysis, that strengthen the value of the organization to the enterprise.

It is no wonder that 54 percent of shared services leaders believe that RPA will be the most important technology to the future of accounts payable and procure-to-pay, per SharedServicesLink’s research.

Is AP automation a priority for your shared services organization? If so, we want to speak with you.

The Edenred PayEdenred Pay is the market leader in B2B payments automation. AP automation solution digitizes and simplifies invoice processing using emerging technologies such as RPA, digital mailroom, intelligent data captureAI-powered technology that extracts, validates, and structures data from invoices or documents with high accuracy., dynamic workflows, artificial intelligence, machine learning, mobile approvals, and invoice analytics.

_______________________________________________________________________________________________________

Edenred PayEdenred Pay is the market leader in B2B payments automation., an Edenred Company, is the global leader in invoice-to-pay automation. Our integrated platform connects businesses with suppliers, ERPs, banks, FinTechs, and payment rails to automate, optimize, and monetize the entire B2B payments lifecycle – from invoice receipt through payment reconciliationThe process of matching financial records—such as payments and invoices—to ensure accuracy in accounting and reporting.. Edenred Pay’s efficient, integrated solutions create a frictionless process and help deliver value to the enterprise by enhancing visibility and monetizing AP.

Visit www.edenredpay.com or contact us to learn more.

Ready to elevate your B2B payments?

Whether you are automating for the first time, ready to refresh your existing technology, or looking for ways to complete the ‘last mile’ of automation, Edenred Pay can help. Let’s chat about your needs.