Make AP Automation Work for You

The best AP automation solutions can help an accounts payable department manage any paper or electronic invoice, no matter where staff work.

Paper documents — invoices included — are still prevalent in today’s business world.

How do we know? The Association for Information and Image Management (AIIM) recently surveyed their members (professionals focused on improving their company’s organizational performance) in order to collect data on their use of paper in their everyday processes.

The survey was translated into a report titled Winning the Paper Wars. According to the report:

- 41% of businesses report an annual decrease in their amount of paper use

- 40% said the flow of paper through their business remains about the same as in years past

- 19% said the amount of paper they see on a regular basis is increasing

Despite best efforts to streamline their information governance programs, we aren’t surprised less than half of the companies surveyed have been able to reduce the volume of paper used in their everyday business processes. One reason businesses aren’t able to control paper is that their electronic document system is not being used properly.

If you can relate to those respondents pained by paper, we have some tips for you. They will help you better use your accounts payable system while reducing the amount of paper invoices you handle.

How to streamline paper processing

Adopting an electronic document management system doesn’t mean paper will completely go away. You may work with vendors or partners that are stuck with an archaic paper process or worse. And some of your business processes may rely on tangible paper trails. Not to mention the volumes of paper from years past that sit, filling up your file rooms or storage lockers.

The best thing you can do for yourself and your company is to admit that paper will not completely go away. Only then can you properly manage paper and streamline your processes, whether in accounts payable or another department.

The benefits of scanning and data capture

No matter what form you receive invoices (PDFs, paper faxes, Excel files, handwritten forms, etc.), make sure they can be approved and posted directly into your ERP as quickly and efficiently as possible. Upon receiving paper, your first step should be to digitize the file. From there on out, you streamline your invoice processes by ensuring you only deal with electronic files.

AIIM’s survey found that:

- Only 31% of companies actually digitize paper documents before the start of a process

- 26% of companies receive and continue to use paper throughout a process and only digitize the file afterwards

- A mere 10% reported utilizing digital mail room services to completely eliminate the intake of paper

Chances are your system can either extract data from electronic files or has a partner service to handle data extraction and upload to your system. If neither are true of your system, there are many companies out there able to handle document receipt, data extraction, and data upload for you.

Once all of your files are digital, align your accounts payable processes to fit a completely digital workflow. There may be a learning curve for working with invoice images, but it will ultimately save you time and money.

How to reduce paper storage costs

Receiving invoices and other documents in an electronic format is something companies strive for when attempting to go paperless. Unfortunately, old methods for processing data can rear their ugly heads and you may find your staff printing out electronic documents in order to process them.

According to AIIM:

- Nearly a third of organizations process electronic documents, forms, and PDFs differently than scanned paper

- 20% of companies reported that they print out electronic documents in order to process them

- 13% said after printing documents they received electronically, they scan the documents to enter them into their document management system

Not only does working off paper leave you vulnerable to losing or ruining data, it adds to your processing time. Additionally, it makes it harder to track the status of the information in your workflow. This is especially true in invoice processing.

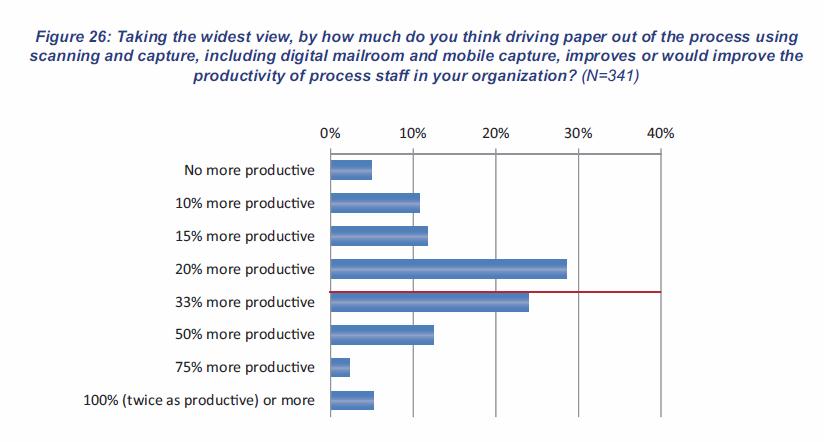

How AP automation solutions improve staff productivity

Phasing out paper documentation in accounts payable and elsewhere not only helps businesses stay more organized, but can also help make employees more productive and improve company response time, which in turns impacts the bottom line.

AIIM asked organizations to gauge the response time and productivity increases they believe their staff would see utilizing various electronic document managing solutions. Here are the results:

As you can see, almost all respondents reported that their processes could be made more productive by eliminating paper documentation, and 95% of companies believe they would see improvement in their response time.

Most AIIM survey respondents also reported that utilizing paper-free processes—while sometimes requiring an initial up front cost—has been a positive investment for their business.

For this productivity, increased response time, and cost-savings to come to fruition, a business cannot be bogged down by paper. Even if AP automation software is in place, new paper can still flow in and old paper files may still need to be accessed.

To take the next step, make sure your accounts payable automation system is the right fit for your needs.

Want help automating your invoice processing? Let’s chat! Edenred PayEdenred Pay is the market leader in B2B payments automation. would be happy to show you first-hand how our AP automation system can help you manage invoices from their receipt and indexing to cloud-based storage.

________________________________________________________________________________________

Edenred PayEdenred Pay is the market leader in B2B payments automation., an Edenred Company, is the global leader in invoice-to-pay automation. Our integrated platform connects businesses with suppliers, ERPs, banks, FinTechs, and payment rails to automate, optimize, and monetize the entire B2B payments lifecycle – from invoice receipt through payment reconciliationThe process of matching financial records—such as payments and invoices—to ensure accuracy in accounting and reporting.. Edenred Pay’s efficient, integrated solutions create a frictionless process and help deliver value to the enterprise by enhancing visibility and monetizing AP.

Visit www.edenredpay.com or contact us to learn more.

Ready to elevate your B2B payments?

Whether you are automating for the first time, ready to refresh your existing technology, or looking for ways to complete the ‘last mile’ of automation, Edenred Pay can help. Let’s chat about your needs.