Walmart and Starbucks Hope to Show How Store-Specific Payment Apps Can Increase Customer Loyalty

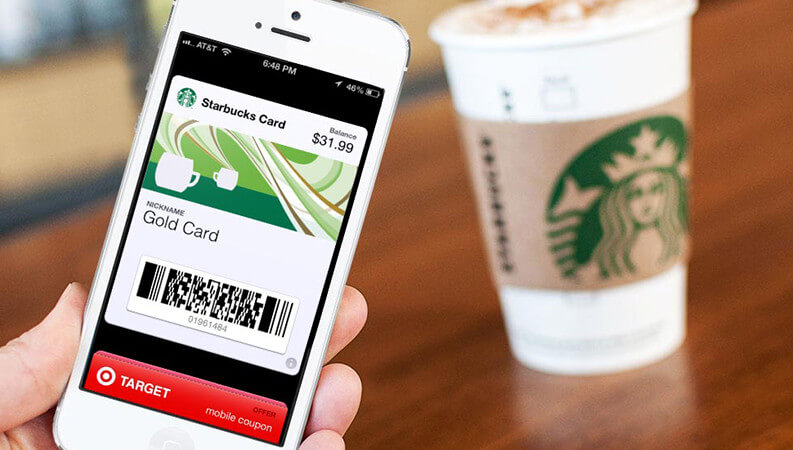

If you’ve bought a coffee at Starbucks recently, you’ve likely noticed multiple customers paying using their smartphones. The company’s app has been recognized as a success, serving as an example for businesses considering their own apps.

One of those businesses watching Starbucks’ mobile payment success is Walmart. The company recently announced the launch of its own mobile payment technology. After the chain of superstores initially declined to accept Apple Pay, buzz began circulating that the company would come up with a payment app of its own. That app turned out to be an add-on to Walmart’s existing app that the company hopes will replace checks and credit cards at the register. Here are some comparisons between the two app ventures.

Loyal Customer Bases

One thing setting Starbucks apart from other retailers is its loyal customer base. Many coffee drinkers stop by Starbucks every morning on the way into work. They’re in a hurry and they don’t want to deal with digging through their pockets or handbags for cash or plastic. Since their smartphones are almost always close by, it’s easier to pull up the Starbucks app and present it to be scanned at the register. The company also now offers Mobile Order and Pay, which allows customers to skip the line altogether by placing their orders and paying through their smartphones, then progressing directly to the order pickup line.

Does Walmart have that same built-in customer base? Many shoppers are in the company’s stores on at least a once-per-week basis, which means they’ll likely be looking for convenience. However, by launching a blackout of all other mobile payment methods but its own, the company may lose quite a few customers, as well, once mobile pay gains traction. Starbucks plans to accept Apple Pay in addition to its own app to accommodate the many customers who own Apple Watches.

A Culture of Loyalty

As Walmart customers know, the chain has always eschewed rewards programs and big sales in favor of having “everyday low prices.” While this strategy has worked well for the company in the past, it may inhibit the company’s mobile payment app. Starbucks lets customers earn points toward future purchases with each payment, with customers progressing upward to higher levels every time they buy a cup of coffee.

The major difference between Starbucks and Walmart is customer base. Walmart is one of the few retailers that still sees a high amount of cash and personal check transactions each day. Starbucks, on the other hand, tends to attract professionals who don’t mind paying top dollar for a cup of coffee they could get for less at the gas station next door. This customer base tends to be early adopters of the latest technology with no problem using an app to pay. Will Walmart’s customers be comfortable paying with their phones when they could just pay by cash or check? Only time will tell.

Additional Features

Convincing customers to download an app, create a username and password, and regularly use that app requires making it truly useful. While paying for weekly purchases in one store might convince a few customers, Starbucks counts on daily buyers and many of those buyers want as seamless a buying process as possible. Even at that, the company has added in the ability to skip long ordering lines as an incentive to download the app and use it for the entire experience.

To truly succeed, Walmart may need to add additional conveniences to its app. The company could add in conveniences like allowing customers to scan their own items as they shop, then have a cashier double check the shopping list to make sure everything has been scanned properly. This would speed up the checkout process while giving customers further reason to download the app.

Mobile payments will only gain in popularity in the next few years. To become an integral part of this, brands have to create apps that improve the customer experience enough to encourage them to download and use them. Brands may also have to consider alternative payment apps like Apple and Android Pay in addition to their own apps to make sure they’re meeting the needs of their customers.

Ready to elevate your B2B payments?

Whether you are automating for the first time, ready to refresh your existing technology, or looking for ways to complete the ‘last mile’ of automation, Edenred Pay can help. Let’s chat about your needs.