What does it cost to process a supplier invoice?

What is the average cost to process an invoice? No matter what your current cost of processing an invoice, Edenred Pay can reduce these costs with AP automation.

Ever wonder whether your accounts payables department is spending too much to process supplier invoices?

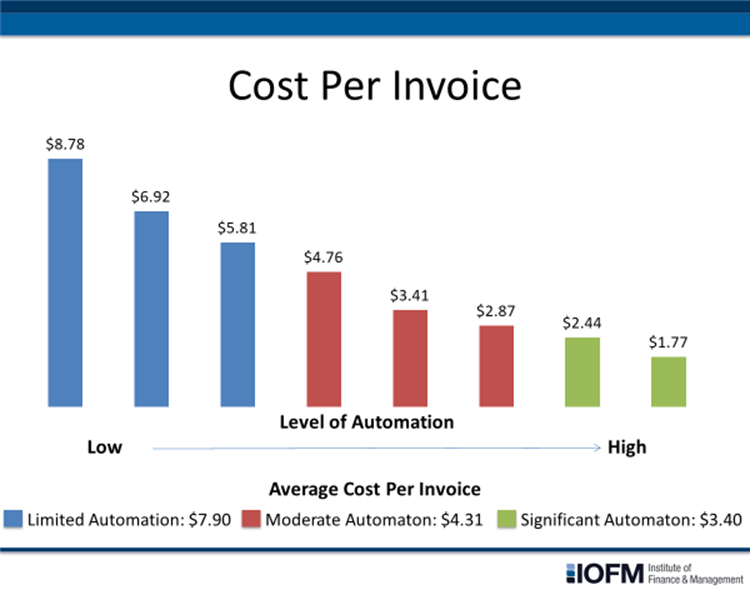

Benchmarking data from the Institute of Finance and Management (IOFM) can give you a clue.

Here are the average costs to process a single supplier invoice, according to IOFM:

- $7.90: What accounts payable departments with little or no automation (mostly or completely manual processes) spend on average to process a single invoice.

- $4.31: What accounts payable departments with a moderate level of automation (lots of manual processes) spend on average to process a single invoice.

- $3.40: What accounts payable departments with a high level of automation (few manual processes) spend on average to process a single invoice.

Of course, many accounts payable departments with little or no automation spend considerably more than $7.90 to process a single supplier invoice. Additionally, best-in-class AP departments – which typically have the highest levels of automation – may spend much less than $3.40 per invoice.

It’s also important to note that IOFM’s average invoice processing costs are based on compensation and benefits for full-time equivalents, but don’t consider allocations such as office space and utilities.

Six reasons your invoice processing costs are so high!

IOFM’s research finds there are six big contributors to the high cost of invoice processing:

1. Lots of paper invoices from suppliers.

The more paper invoices that an accounts payable department receives from its suppliers, the lower the percentage of invoices that are posted to an ERP application straight-through, without human operator intervention, studies show.

2. Keying or OCR errors.

Manually keying or using OCR to extract invoice data and inputting information on approved invoices into an ERP application is a costly, error-prone process that opens the door to duplicate or incorrect supplier payment. Detecting keying and OCR errors late in the approval process increases the chances of late-payment penalties and missed early-payment discount opportunities.

3. Poor cash flow visibility.

Manual or offline invoice processes provide limited visibility into the metrics businesses rely on to manage their cash: Days Payable Outstanding (DPO), on-time payment percentage, accounts payable value and payment and discount capture metrics. What’s more, payables staff can never be sure when an invoice is approaching its early payment discountA financial incentive is provided by a supplier to encourage early payment of invoices. deadline, the best time to release payments or when to take advantage of discount offers.

4. Poor control over spending.

Paper-based and offline processes make it difficult for businesses to access what they need to control corporate spending, including enterprise spend and trends, category spend and volume, spend-to-supplier ratio, supplier performance and budget variances.

5. A high percentage of supplier invoices that result in exceptions.

Seventeen percent of all supplier invoices result in an exception, Ardent Partners reports. There are lots of causes of exceptions, including wrong price, wrong quantity, missing tax amount, and missing tax ID numbers. Exceptions are also caused when there’s no requester name, contact information, contract and/or purchase order, or missing purchase order numbers. Missing shipping notices and incorrect net amounts also cause exceptions.

Resolving exceptions manually or using email typically involves multiple handoffs. There are several emails and manual processes to identify and resolve the cause of the exception. These lengthy processes significantly add to the costs and delays approval. Making matters worse, exceptions can languish on desks or in e-mail boxes awaiting resolution.

6. Greater risk of compliance violations.

It is difficult to meet compliance requirements in a manual or offline invoice processing environment. Manual or offline invoice approval processes do not provide tracking of invoice history and approvals or enforcement of approval policies. They also lack separation of duties guidelines, chain of custody assurances, and readily available audit information.

Manual processes don’t have controls for Sarbanes-Oxley and Payment Card Industry Data Security Standard (PCI DSS). And they make it difficult to prevent documents from being discarded or destroyed ahead of pre-set deadlines. This lack of control also makes accounts payable departments more vulnerable to fraud.

Manual invoice or offline approval processes exacerbate, if not cause, all the contributors to high costs.

It is no surprise that accounts payable controllers surveyed by IOFM identify accounts payable as the most time-consuming, laborious, and paper-intensive finance and administration function, ahead of burdensome activities such as accounts receivable, payroll, tax, and audit and reporting.

In fact, accounts payable received nearly twice as many votes from controllers as the most time- and labor-intensive finance and administration function than the next highest-ranked function.

Don’t settle for sky-high invoice processing costs.

Technologies such as digital mailroom, intelligent data captureAI-powered technology that extracts, validates, and structures data from invoices or documents with high accuracy., workflow automation, robotic process automation (RPA), artificial intelligence (AI)The use of computer systems to simulate human intelligence processes like learning, reasoning, and decision-making—often applied in AP automation for data capture, fraud detection, and workflow optimization. B, machine learning (ML)A subset of AI that allows systems to learn from data and improve over time without being explicitly programmed—used in automation to improve accuracy and prediction., mobile and analytics enable accounts payable departments to transform their operations to reduce the costs of processing supplier invoices.

- Invoices in any format, from any channel are received and aggregated onto a single platform

- Header and line-item data is extracted from invoices with 99.95 percent accuracy

- Extracted data is validated against information residing a system of record.

- Invoices are matched against purchase orders and shipping receipts

- Invoices requiring approval are digitally routed based on pre-set rules

- Accounts payables staff, stakeholders and suppliers collaborate online to resolve exceptions

- Approved invoices are seamlessly posted to an ERP application

- Invoice images and data are securely archived and available for instant retrieval

Want to reduce your cost to process an invoice?

If so, the Edenred PayEdenred Pay is the market leader in B2B payments automation. AP automation system can help with advanced technology, delivered as a service.

_________________________________________________________________________________________

Edenred PayEdenred Pay is the market leader in B2B payments automation., an Edenred Company, is the global leader in invoice-to-pay automation. Our integrated platform connects businesses with suppliers, ERPs, banks, FinTechs, and payment rails to automate, optimize, and monetize the entire B2B payments lifecycle – from invoice receipt through payment reconciliationThe process of matching financial records—such as payments and invoices—to ensure accuracy in accounting and reporting.. Edenred Pay’s efficient, integrated solutions create a frictionless process and help deliver value to the enterprise by enhancing visibility and monetizing AP.

Visit www.edenredpay.com or contact us to learn more.

Ready to elevate your B2B payments?

Whether you are automating for the first time, ready to refresh your existing technology, or looking for ways to complete the ‘last mile’ of automation, Edenred Pay can help. Let’s chat about your needs.